Nikkei 225 Overview

The Nikkei 225 is the primary stock market index for Japan, tracking the performance of the 225 largest companies listed on the Tokyo Stock Exchange (TSE). Established in 1950, it is one of the oldest and most widely followed stock indices globally.

The Nikkei 225, a barometer of Japan’s economic health, has been on a rollercoaster ride lately. Its ups and downs are as unpredictable as the twists and turns of Game of Thrones: Laurenti. Just when you think it’s going to soar, it takes a sudden plunge, leaving investors wondering what’s next.

But despite its volatility, the Nikkei 225 remains a bellwether for the Japanese economy, and its movements are closely watched by investors around the world.

The index is calculated using a weighted average method, with each company’s stock price weighted by its market capitalization. This means that larger companies have a greater influence on the index’s overall value. The Nikkei 225 is a capitalization-weighted index, meaning the weight of each stock in the index is proportionate to its market capitalization.

Key Sectors and Companies

The Nikkei 225 represents a diverse range of industries, with major sectors including technology, manufacturing, finance, and consumer goods. Some of the most prominent companies listed on the index include Toyota Motor Corporation, Sony Corporation, SoftBank Group, and Mitsubishi UFJ Financial Group.

The Nikkei 225, Japan’s benchmark stock index, has been on a rollercoaster ride in recent months, mirroring the ups and downs of the global economy. But amidst the volatility, one constant has been the allure of Rosabell Laurenti Sellers , the enigmatic actress who has captivated audiences with her performances in “The Haunting of Bly Manor” and “Game of Thrones.” Like the Nikkei 225, Rosabell’s career has been marked by both highs and lows, but her resilience and talent have ensured that she remains a force to be reckoned with in the entertainment industry.

Factors Influencing Nikkei 225 Performance

The Nikkei 225 is influenced by a complex interplay of economic, political, and market factors. These factors can have a significant impact on the index’s performance, both in the short and long term.

Economic Factors

- Gross Domestic Product (GDP) growth: Strong economic growth typically leads to increased corporate profits and higher stock prices.

- Inflation: Rising inflation can erode the value of corporate earnings and reduce the attractiveness of stocks as an investment.

- Interest rates: Low interest rates make borrowing more affordable, which can boost economic activity and stock prices.

- Currency exchange rates: A weaker yen makes Japanese exports more competitive, which can boost corporate profits and the Nikkei 225.

Political Factors

- Government policies: Government policies, such as fiscal stimulus or tax reforms, can have a significant impact on the economy and the stock market.

- Political stability: Political instability can create uncertainty and reduce investor confidence, leading to lower stock prices.

- International relations: Japan’s relations with other countries, particularly China and the United States, can affect the economy and the Nikkei 225.

Market Factors

- Investor sentiment: Investor sentiment can have a significant impact on the Nikkei 225. Positive sentiment can lead to higher stock prices, while negative sentiment can lead to lower prices.

- Technical analysis: Technical analysts use historical price data to identify patterns and trends that can help them predict future price movements.

- Global economic events: Global economic events, such as the COVID-19 pandemic or the Russia-Ukraine war, can have a significant impact on the Nikkei 225.

Technical Analysis of Nikkei 225

Technical analysis is a method of evaluating securities by analyzing statistics generated from market activity, such as past prices and volume. Technical analysts believe that past price movements can be used to predict future price movements.

Chart Patterns

Chart patterns are one of the most important tools used by technical analysts. They are formed by the price action of a security over time and can be used to identify potential trading opportunities.

- Head and shoulders pattern: This pattern is formed when the price of a security makes three peaks, with the middle peak being the highest. The neckline is the line that connects the lows of the two shoulders. A break below the neckline is considered a bearish signal.

- Double top pattern: This pattern is formed when the price of a security makes two peaks at the same level. The neckline is the line that connects the lows of the two peaks. A break below the neckline is considered a bearish signal.

- Double bottom pattern: This pattern is formed when the price of a security makes two troughs at the same level. The neckline is the line that connects the highs of the two troughs. A break above the neckline is considered a bullish signal.

Trendlines, Nikkei 225

Trendlines are another important tool used by technical analysts. They are lines that connect two or more points on a price chart and can be used to identify the trend of a security.

- Upward trendline: This line is drawn from the bottom of a swing low to the top of a swing high. It indicates that the security is in an uptrend.

- Downward trendline: This line is drawn from the top of a swing high to the bottom of a swing low. It indicates that the security is in a downtrend.

Indicators

Indicators are mathematical formulas that are used to analyze the price action of a security. They can be used to identify trends, momentum, and overbought or oversold conditions.

- Moving averages: Moving averages are one of the most popular indicators used by technical analysts. They are calculated by taking the average of the closing prices of a security over a specified period of time.

- Relative strength index (RSI): The RSI is a momentum indicator that measures the magnitude of recent price changes. It is calculated by comparing the average of the up closes to the average of the down closes over a specified period of time.

- Stochastic oscillator: The stochastic oscillator is a momentum indicator that measures the relationship between the closing price of a security and its high and low prices over a specified period of time.

Key Support and Resistance Levels

Key support and resistance levels are important levels that can be used to identify potential trading opportunities. Support is a level at which the price of a security has difficulty falling below, while resistance is a level at which the price of a security has difficulty rising above.

Key support and resistance levels can be identified using a variety of methods, such as chart patterns, trendlines, and indicators.

Potential Trading Strategies

There are a variety of potential trading strategies that can be used to trade the Nikkei 225. Some of the most popular strategies include:

- Trend following: Trend following is a strategy that involves buying a security when it is in an uptrend and selling it when it is in a downtrend.

- Momentum trading: Momentum trading is a strategy that involves buying a security when it is showing strong momentum and selling it when it is showing weak momentum.

- Breakout trading: Breakout trading is a strategy that involves buying a security when it breaks out of a support or resistance level.

The best trading strategy for you will depend on your individual risk tolerance and trading style.

The Nikkei 225 index plunged today, news of a beloved french singer dies sending shockwaves through the market. Traders watched in disbelief as the index plummeted, with some analysts attributing the drop to the outpouring of grief from the singer’s fans.

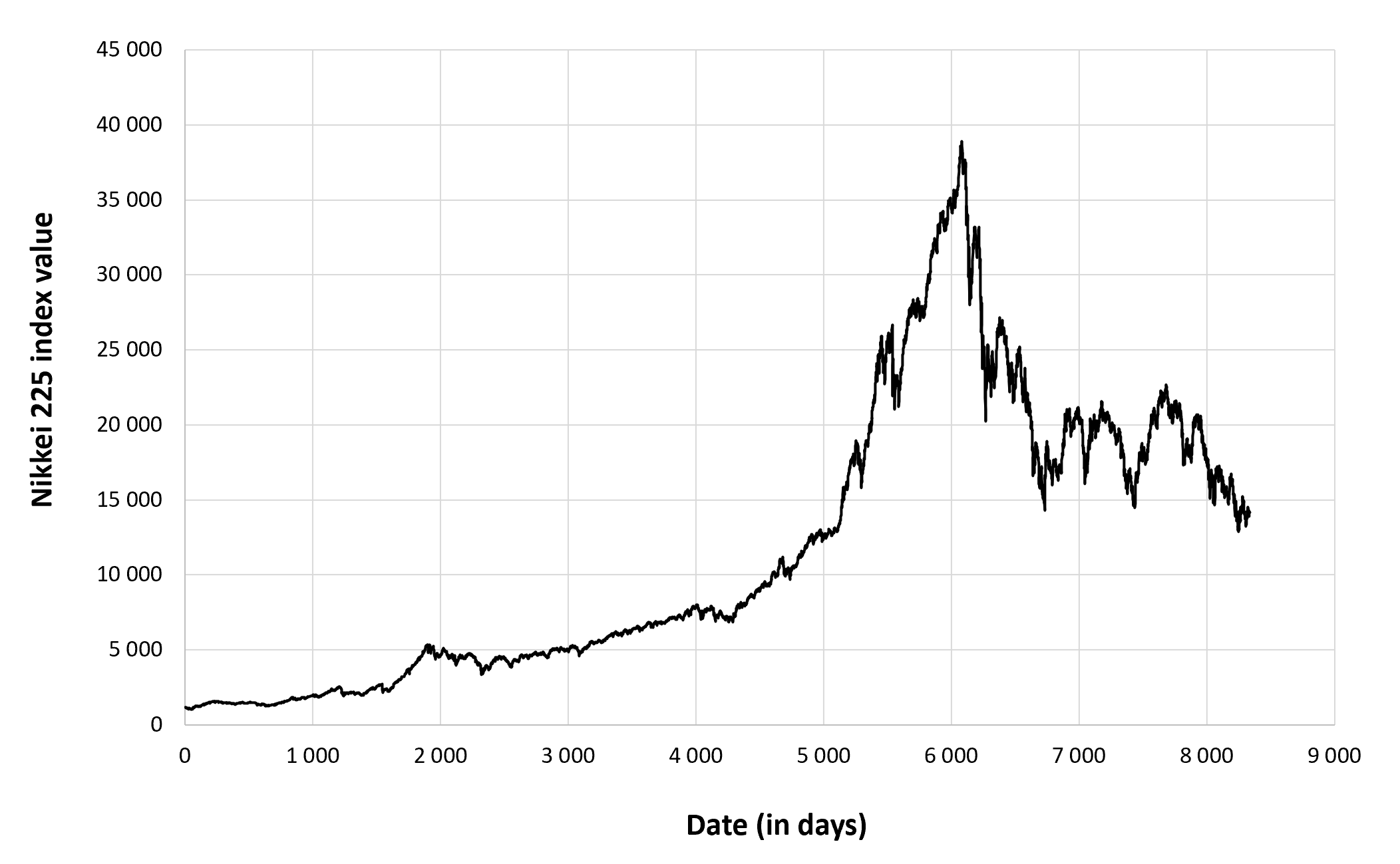

The Nikkei 225, Japan’s benchmark stock index, has been on a roller coaster ride lately. After hitting a 30-year high in October 2021, it has since fallen by more than 20%. Some analysts believe that the index is now undervalued and could be a good investment opportunity.

However, others are more cautious, citing concerns about the global economy and the upcoming house of the dragon season 2 episode 1. Despite the uncertainty, the Nikkei 225 remains one of the most closely watched stock indices in the world.

The Nikkei 225, Japan’s primary stock market index, is a barometer of the country’s economic health. However, if you’re more interested in entertainment, you might be wondering what time does Game of Thrones air ? The popular fantasy series airs on HBO on Sundays at 9 pm EST.

Back to the Nikkei 225, its performance can provide insights into investor sentiment and the overall direction of the Japanese economy.